A blog update to You’ve Got Money

No one likes to come up short. Not at the grocery store, not on the car payment, and certainly not on retirement. Even if you have retirement accounts. Current laws require that upon turning 70 ½, you must take a required minimum distribution, also known as an RMD, each year. (And calculating RMDs is tricky business.) While there are ways to help plan ahead for retirement, like checking the SSA website to see what the RMD for each of your retirement accounts will be, you can still end up short.

Unfortunately, the money needed to fully cover your living expenses won’t magically appear on its own. You can, however, create a revenue stream with longevity and stability.

What is this fantastic peace-of-mind? Two words: Rental properties.

Why Rental Properties?

The short answer is because people understand rental properties/rental homes from owning their own.

Does that mean every house is a rental candidate? Not necessarily. The condition of the home is going to play a big factor in whether or not renting a home is lucrative. However, going for the worst house in the best neighborhood is actually solid advice—particularly if you have good credit.

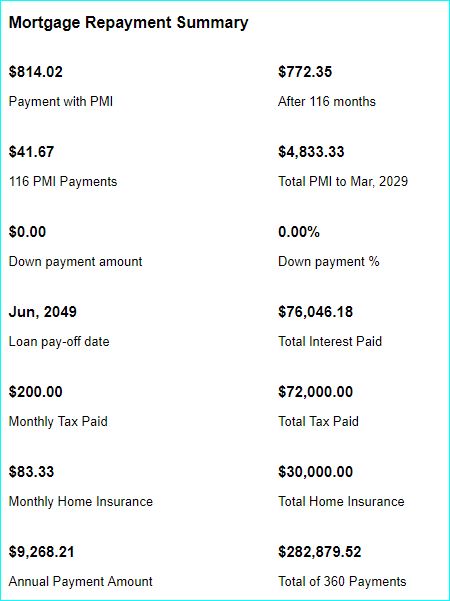

See, for investors with good credit and at least 20% down, mortgages are available to investors. While 30 year terms are the most common, some investors wanting to have the home paid for by retirement may choose a 15 or 20 year term. If you plan on turning your current home into a rental, taking advantage of a 0% down program may be an option depending on your age and projected length of the loan. One of the downsides with paying 0% down on a property is Private Mortgage Insurance (PMI), which is required by lenders when less than 20% of the loan is put down. This does create a bigger monthly payment for you.

To have an idea of what payments would look like, use a mortgage calculator, such as MortgageCalculator.org. Bear in mind that different factors will affect affordability and rentability.

Let’s use a scenario together here to demonstrate. To start off, we’ll keep a couple metrics the same—our constant variables (if you recall from middle school science class):

House Value: $100,000

Interest Rate: 4.2% (fixed)

Loan Type: Conventional

Credit Rating: Good (620-719)

Property Tax: $200 a month ($2,400 a year)

Homeowners Insurance: $83.33 a month ($1,000 a year)

Property Management Fee: 10% of rental income

The main scenario works like this: You’ve bought a home and the mortgage payment is an unknown variable (M). According to Amanda Dixon at SmartAsset, “If your home is worth $100,000 or less, it’s best to charge rent that’s close to 1% of your home’s value.” So that makes the monthly rent $1,000. This introduces two more constant variables.

Rent: $1,000 a month ($12,000 a year)

Property Management Fee (in dollars): $100 a month ($1,200 a year)

From here, we’ll compare a 30 year loan to a 15 year loan. We’ll also compare the effect of paying the 20% down versus 0% down on the mortgage payment.

The monthly payment listed in the screenshots below always factors in the Principal, Interest, and Taxes; it does not take into account Insurance. This will affect whether you can afford a property manager while paying off the property or if that would need to wait until the property was paid off. The calculation for this comes down to Monthly Rent - (Monthly Payment + Insurance) - Property Management Fee.

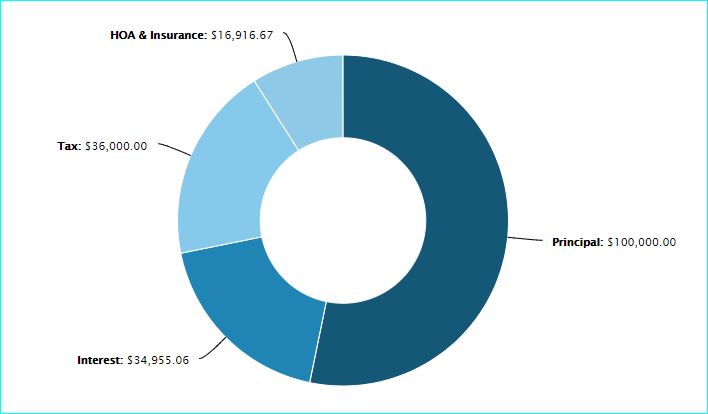

Calculation of 15 year loan at 20% down

.png)

.png)

$1,000 - ($883.13 + $83.33) - $100 =

$1,000 - $966.46 - $100 =

$33.54 - $100 = -$66.46

Can you afford a property manager? Not until the property is paid off.

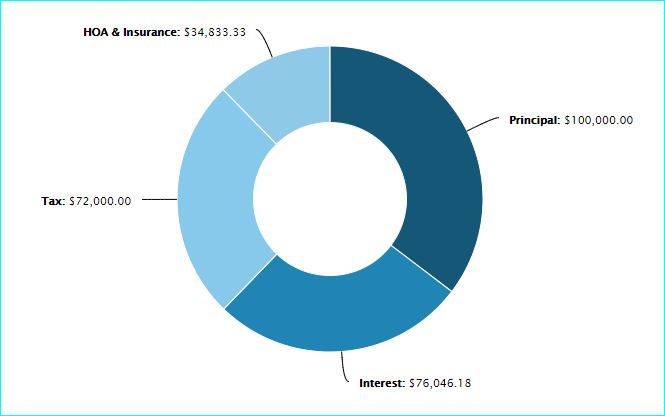

Calculation of 15 year loan at 0% down

$1,000 - ($1,074.75 + $83.33) - $100 =

$1,000 - $1,158.08 - $100 =

-$158.08 - $100 = -$258.08

Can you afford a property manager? Not until the property is paid off.

At only 1% of the total home cost ($100,000), the $1,000 a month rent is not sufficient to fully pay the monthly rent. Even after exceeding the 20% down mark and the lender no longer requiring PMI, the rent would still fall short of the minimum monthly payment.

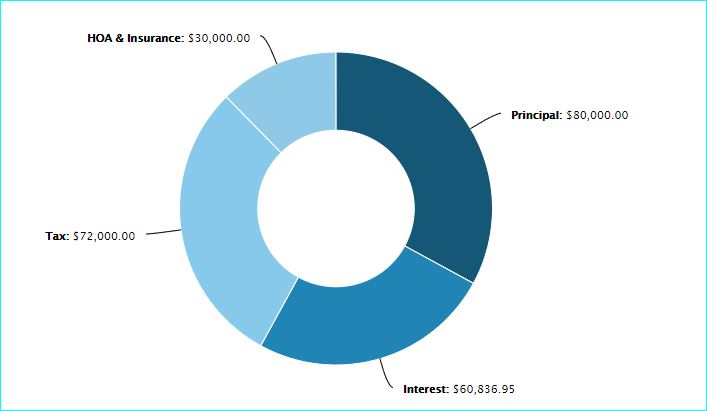

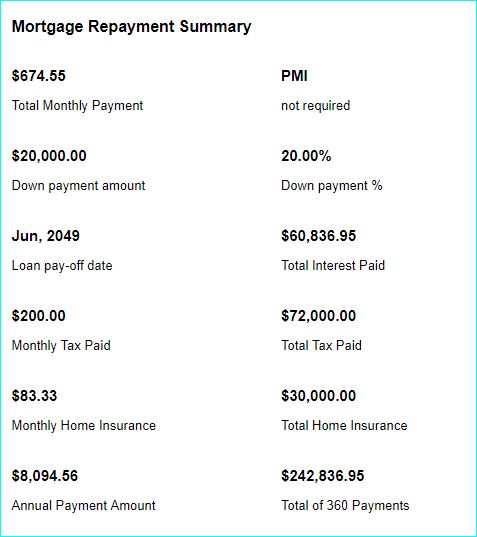

Calculation of 30 year loan at 20% down

$1,000 - ($674.55 + $83.33) - $100 =

$1,000 - $757.88 - $100 =

$242.12 - $100 = $142.12

Can you afford a property manager? Yes!

Calculation of 30 year loan at 0% down

$1,000 - ($814.02 + $83.33) - $100 =

$1,000 - $897.35 - $100 =

$102.65 - $100 = $2.65

Can you afford a property manager? Yes!

While the 30 year loans do allow for you to have a property manager, the income is relatively small. This also doesn’t factor in any repair costs or other incidentals that may arise. As a general rule of thumb, it’s always a good idea to have savings set aside—a rental property is no different.

.png)

How to Choose

There are a lot of factors that go into what makes a good rental property. In addition to aiming for a middle-sized home with 3-4 bedrooms and 2-3 baths, FlipNerd’s Hannah Alley also suggests, “In general, you want a “clean” property, meaning it doesn’t need many repairs and doesn’t have any “big 5” issues (roof, HVAC, plumbing, electrical, and foundations). Big repairs, if not properly budgeted for, can eat away at your potential profit and leave you at a loss.”

Admittedly, this is another one of the other great reasons to choose a house that is average/slightly below average condition in a good, owner-occupied neighborhood—ease of property care.

Another point comes down to attraction. Prospective tenants feel more inclined (i.e. attracted) to rent in these areas. And thanks to the quality of these owner-occupied neighborhoods, you can charge fair but sizable rent, which translates into a higher level revenue stream. Tenants in these areas tend to rent longer, have great stability, and pay on time. Andrea Collatz at TransUnion’s Smart Move blog points out, “It’s all about lifestyle quality, and a great tenant is often willing to pay more or overlook less desirable aspects of the rental unit if the property is in a great neighborhood.” Clean, maintain, and update the property to keep tenants interested and happy.

.png)

All right, I’ve got the house—now what?

Time for some reading and prep! This includes setting up ground rules for yourself what you as the landlord will or will not allow.

Even if you do hand over the actual management to a property management company, take the time to understand the following:

Understand property management fees

Typically, a property management company charges 10-20% of the rental income to manage the property. If you are physically unable to manage the property yourself (don’t live nearby, incapacity/disability, no time), this is a great way to still invest and make a profit.

Speaking of property management, see how you can still make money using property manager!

A property management company knows how to maximize rent, advertise, handle tax deductions, and enables you to remain location independent of the property. They do the work and you still get the income!

Forecast the profitability of your rental or rentals, and adjust accordingly

If you intend to go it alone, be prepared for a LOT of spreadsheets. Spending even 20 hours of your time a week at a rate of $20 an hour is a loss of $400 each month. Or have a property management company handle the legwork for you and save both time and money.

Check our list of 5 suggestions before renting out your home

Big thing to learn: Capital Expense vs Current Expense. You will thank yourself come tax time.

Create a repair addendum and follow it faithfully

You should include anything that doesn’t affect the habitability of the property (and you’re willing to pay for) in the appliance addendum.

Decide if you’re going to be pet-friendly and, if so, how to protect yourself…

Along with creating an easy to clean and maintain property, be sure to interview both owner AND pet.

...and decide if small dogs really ARE the only size of pup you should allow

Keep a list of unacceptable behaviors outlined in your pet rental agreement.

Get an idea of common landlord woes and how to overcome them

Past due utilities, roofing issues, communication problems—know what problems can sneak up on you and be ready.

Make sure to keep rent in pace with inflation and fair for the area

Hot tip! Get a realtor’s opinion. This is their field of expertise and they’ll have an idea on how your property compares to others in that area.

Remember: If you’re worried about enforcing these rules or don’t want to have to worry about late night calls or collecting the rent, getting the help of a trusted property management company is a worthwhile investment. You want to enjoy your golden years in (relatively) peace and there’s no shame in that.

.png)

Capping It Off

If you choose to own multiple investment properties, let someone else handle the heavy lifting for you. Besides, owning multiple properties means more revenue streams and greater stability. Maximize your rental potential with fewer headaches for a relatively small cost? Um...can we say “heck yeah”? Retirement is inevitable. How you choose to retire is up to you.

Navy to Navy Homes

4540 Southside Blvd, Suite 702

Jacksonville, FL 32216

904-900-4766

.png)